Why Poly-Woven Packaging Market Manufacturers are Successful

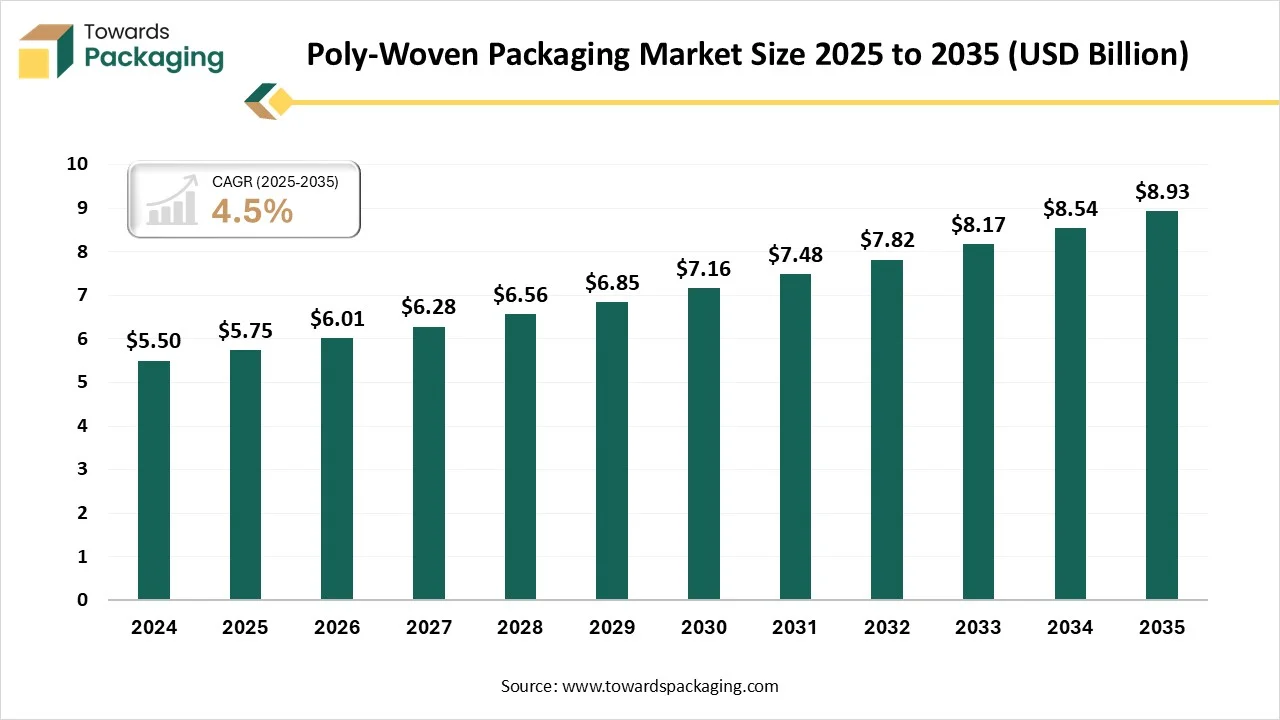

As highlighted by Towards Packaging research, the global poly-woven packaging market, valued at USD 5.75 billion in 2025, is expected to reach USD 8.93 billion by 2034, registering a CAGR of 4.5% throughout the forecast period.

Ottawa, Jan. 13, 2026 (GLOBE NEWSWIRE) -- The poly-woven packaging market size reached USD 5.50 billion in 2024, grew to USD 5.75 billion in 2025, and is projected to hit around USD 8.93 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034. According to data published by Towards Packaging a sister firm of Precedence Research.

The market is growing due to rising demand for durable, lightweight, and cost-effective packaging solutions across agriculture, food grains, chemicals, and construction industries.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Technological Shifts

- Adoption of advanced extrusion and weaving technologies to improve tensile strength, uniformity, and load-bearing capacity.

- Growing use of lamination and coating innovations for better moisture resistance, print quality, and product protection.

- Integration of automation and smart manufacturing systems to enhance production efficiency, reduce waste, and maintain consistent quality.

- Development of recyclable and eco-friendly poly-woven materials, including mono-material structures, to meet sustainability regulations.

What is Poly-Woven Packaging?

The poly-woven packaging market is witnessing rapid growth driven by rising demand from the building, agriculture, food grains, chemical, and fertilizer industries. Its strength, durability, lightweight, and affordability when compared to conventional packaging materials are the reasons for its popularity. The need for bulk transportation and increased international trade is driving market growth. Additionally, market adoption is being positively impacted by the increased emphasis on reusable and recyclable packaging options.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5930

Private Industry Investments for Poly-Woven Packaging:

- Mondi Group's European Expansion: Mondi acquired Schumacher Packaging's Western European assets to strengthen its position in the corrugated and sustainable packaging markets.

- Uflex Ltd.'s North American Acquisition: Uflex expanded its global reach by acquiring Flex Films USA, bolstering its production capabilities and market presence in North America.

- Emmbi Industries' Sustainable Merger: Emmbi Industries merged with GreenPack Solutions to enhance its product line with innovative and eco-friendly woven packaging options.

- Pratap Group's Tech Investment: Pratap Group invested in advanced Windmöller & Hölscher (W&H) machinery to increase manufacturing capacity and focus on sustainable, differentiated solutions.

Market Opportunities

- Rising demand for sustainable and recyclable packaging creates opportunities for eco-friendly poly-woven bags and mono-material solutions.

- Growth in agriculture and food grain exports increases the need for strong bulk packaging for safe storage and transportation.

- Expanding construction and infrastructure activities boost demand for cement, sand, and chemical packaging.

- Increasing preference for custom-printed and branded packaging opens avenues for value-added and premium products.

- Rapid industrialization and urbanization in emerging economies offer untapped market potential for manufacturers.

Market Outlook

- Industry Growth Overview: The poly-woven packaging market is growing steadily due to rising demand from agriculture, construction, and industrial sectors for durable and cost-effective bulk packaging.

- Sustainability Trends: Manufacturers are shifting toward recyclable, reusable, and mono-material poly-woven solutions to meet sustainability goals and regulatory norms.

-

Startup Ecosystem: Startups focus on eco-friendly materials, smart packaging, and innovative printing to create differentiated and sustainable packaging solutions.

Segmental Insights

By Material Type

The polypropylene (PP) segment dominated the poly-woven packaging market because of its exceptional strength, cost-effectiveness, lightweight design, and chemical resistance. PP is widely used in a variety of industries, including construction, chemicals, and agriculture, where dependability and durability are essential for storage and transportation. Its status as the top material for poly-woven packaging has been solidified by its demonstrated performance in large-scale handling and long-term storage.

The biodegradable/recyclable blends segment is growing rapidly, motivated by consumer demand for sustainable packaging, government regulations, and growing environmental consciousness. To meet the increasing demand for recyclable and compostable packaging solutions across industries, manufacturers are investing in eco-friendly polymers and blends.

By Capacity

The medium (10-25kg) segment dominated the poly-woven packaging market, providing the perfect ratio of manageability to adequate load capacity because they are practical for daily use, storage, and transportation in farms and industrial facilities. These bags are frequently used for grains, fertilizers, and industrial materials.

The bulk/jumbo (>50kg) segment is growing rapidly, driven by the need for high-volume economic packaging in raw materials logistics, chemical industries, and large-scale agricultural operations. The use of jumbo capacity, poly-woven bags is accelerated by growing international trade and industrial output.

By Printing Type

The printed poly-woven packaging segment is dominated by the poly-woven packaging market because it enables manufacturers to display marketing messaging, product details, and branding. Customization is now simpler thanks to flexographic and digital printing technologies, which help businesses stand out in cutthroat industries like retail, consumer goods, and agriculture.

The minimal/eco-label printing segment is growing rapidly, demonstrating a move toward eco–friendly packaging design and sustainability. To appeal to environmentally conscious consumers and lessen the environmental impact of printing, brands are increasingly implementing straightforward, eco-friendly printing techniques.

By End Use Industry

The agriculture segment dominated the poly-woven packaging market due to the widespread use of bags for storing and transporting grains, seeds, fertilizers, and other farm produce. Durability, moisture resistance, and cost efficiency make poly-woven bags the preferred choice for agriculture supply chains worldwide.

The consumer goods & retail segment is growing rapidly due to rising demand for packaged food, beverages, and household products, which fuels the need for attractive, durable, and branded packaging. Retailers are increasingly adopting innovative designs and sizes to meet consumer expectations and e-commerce distribution needs.

More Insights of Towards Packaging:

- Flexible Packaging Market Grows to USD 511.69 Bn by 2035

- Corrugated Packaging Market Grows to USD 463.09 Bn by 2035

- Europe Flexible Packaging Market Hits USD 76.54 Bn by 2035

- Plastic Packaging Market Reaches USD 664.65 Bn by 2035

- Europe Packaging Market Size & Trends 2035 Packaging Market Size Reaches USD 1.75 Tn by 2035

- North America Flexible Packaging Market Hits USD 123.07 Bn by 2034

- HDPE Packaging Solutions Market Size, Trade Data, Value Chain & Competitive Landscape

- Aseptic Flex Bag Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- High-Barrier Paper Bag Market Size, Trends, Segmentation and Statistical Forecasts Analysis 2025-2035

- PTFE Tapes and Films Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Base Paper for Heat Sealable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Resealable Beverage Can Market Size, Trends, Key Segments and Regional Dynamics with Manufacturers and Suppliers Data

- Foam Cushioning Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Recyclable Thermoform Blister Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Decor Paper Market Size, Trends, Segmentation & Global Opportunity Analysis (2025-2035)

- Ovenable Paperboard Trays Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Gift Wrapping Paper Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Recyclable Plastic Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Egg Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Nanotechnology Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- FMCG Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Connected Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

-

Contract Packaging Market Size (2025-2034), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competition, Value Chain & Trade Data

By Regional

The Asia Pacific region dominates the poly-woven packaging market, backed by a robust manufacturing base, quick industrialization, and high agricultural output. Due to their established supply chains and cost advantages, countries such as China, India, and Southeast Asian countries act as hubs for both production and consumption.

China Poly-Woven Packaging Market Trends

China's market is experiencing steady growth, driven mainly by strong demand from the agriculture, construction, and bulk logistics sectors. Polypropylene (PP) woven bags dominate due to their low cost, durability, and suitability for grains, fertilizers, cement, and industrial materials. Sustainability is becoming a key trend, with increasing focus on recyclable mono-material PP, lightweighting, and the use of recycled content in response to government environmental policies.

North America is growing rapidly in the market, propelled by rising investments in e-commerce, modern agriculture, and sustainable packaging. Demand for superior poly woven packaging solutions is rising due to industrial modernization and growing environmental consciousness.

U.S. Poly-Woven Packaging Market Trends

The U.S. market is growing steadily, driven by strong demand from agriculture, construction, and industrial bulk packaging applications. Polypropylene (PP) woven bags remain the preferred choice due to their durability, cost efficiency, and ability to handle heavy loads. Sustainability is a key trend, with manufacturers focusing on recyclable materials, lightweight designs, and reduced environmental impact to meet regulatory and customer expectations.

Recent Developments in the Poly-Woven Packaging Industry:

- In May 2025, Lakhdatar International Pvt. Ltd. announced an investment in advanced Starlinger machinery to enhance production efficiency and sustainability in woven polypropylene packaging. This move strengthens the company’s ability to serve high-volume agriculture and industrial customers with consistent quality.

- In February 2025, ProAmpac launched advanced recyclable packaging innovations aimed at improving sustainability across flexible and woven packaging applications. These innovations support brand owners in meeting recyclability targets without compromising performance.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Poly-Woven Packaging Market & Their Offerings:

- Palmetto Industries: An American-led global company that produces heavy-duty bulk containers (FIBCs), liners, and laminated bags through a fully integrated manufacturing hub in India.

- Anduro Manufacturing: A sustainable packaging specialist in Honduras that provides high-speed, solar-powered production of woven and film-laminated bags for the North American pet food industry.

- Bischof & Klein GmbH & Co.: A prominent German firm focused on high-tech flexible films and industrial packaging, known for producing ultra-pure medical and pharmaceutical containers in specialized cleanrooms.

- Muscat Polymers Pvt. Ltd.: A major Indian manufacturer that crafts a wide variety of polypropylene woven sacks, fabrics, and protective tarpaulins for export to over 24 countries.

Other Players

- AEP Industries Inc.

- XIFA Group

- Klene Paks Limited

- Shouguang Huayuan Packaging

- Hanoi Plastic Bag JSC

- Da Nang Plastic Joint Stock Company

- Emmbi Industries Ltd.

- Al-Tawfiq Company

Segments Covered in the Report

By Material Type

- Polypropylene (PP)

- Polyethylene (PE / HDPE / LDPE)

- Biodegradable / Recyclable Blends

By Capacity

- Small (up to 10 kg)

- Medium (10–25 kg)

- Large (25–50 kg)

- Bulk / Jumbo (>50 kg)

By Printing Type

- Printed Poly-Woven Packaging

- Unprinted / Plain Packaging

- Minimal / Eco-Label Printing

By End-Use Industry

- Agriculture (Seeds, Fertilizers, Feed)

- Building & Construction (Cement, Sand)

- Food & Beverage

- Chemicals

- Pharmaceuticals

- Textiles

- Consumer Goods & Retail

- Logistics & E-commerce

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5930

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Bulk Container Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Pharmaceutical Contract Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Returnable Glass Bottles Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Polyethylene Films Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Confectionery Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Pharmaceutical Glass Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Coffee Bags Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Pharmaceutical Packaging Equipment Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Packaging Printing Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Skin Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Cohesive Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- U.S. Black Rigid Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Bioplastic Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2024-2035

- Child Resistant Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Biopharmaceuticals Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Carton Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Bottled Water Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Industrial Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.