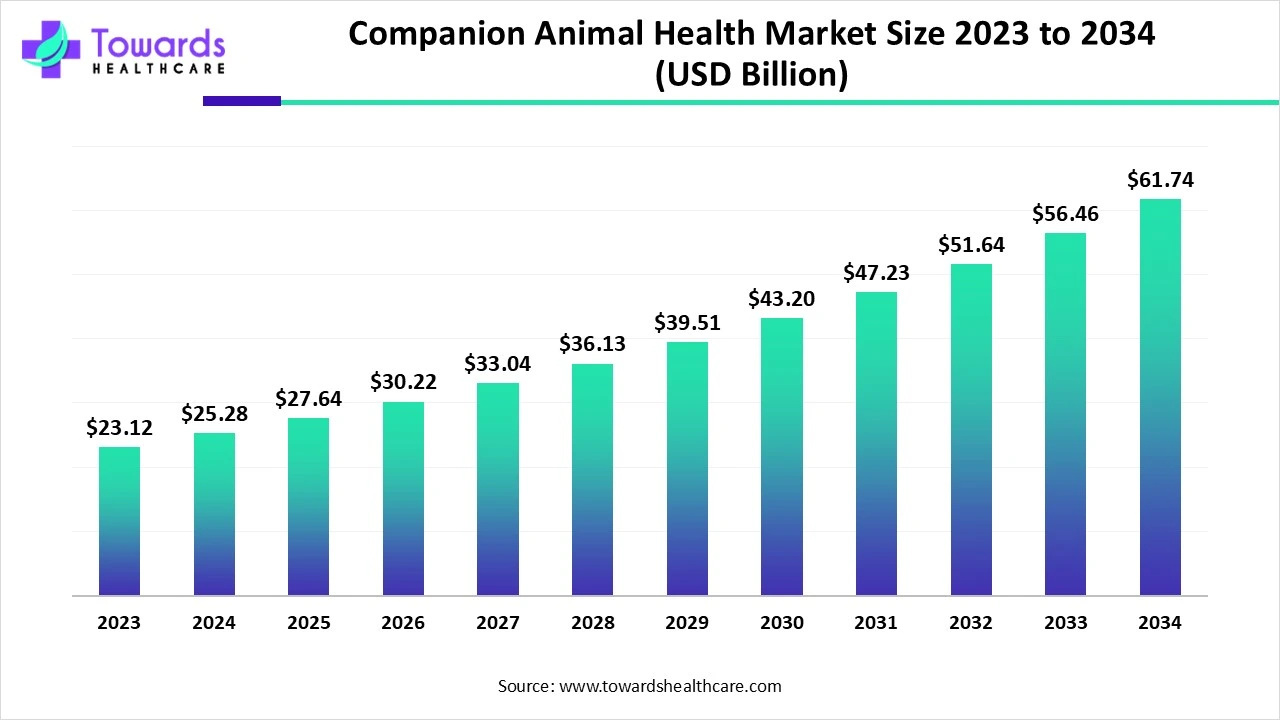

Companion Animal Health Market to Worth USD 61.74 Billion by 2034, Driven by Rising Pet Ownership and Humanization Trends

The companion animal health market size is calculated at USD 27.64 billion in 2025 and is expected to reach around USD 61.74 billion by 2034, growing at a CAGR of 9.34% for the forecasted period.

Ottawa, Oct. 31, 2025 (GLOBE NEWSWIRE) -- The global companion animal health market size was valued at USD 25.28 billion in 2024 and is predicted to hit around USD 61.74 billion by 2034, rising at a 9.34% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising because rising pet ownership, increasing pet humanisation and greater investment in veterinary health solutions are driving an unprecedented demand for companion animal health products and services.

Have questions or need custom insights? Connect with our experts at sales@towardshealthcare.com for tailored guidance!

Key Takeaways:

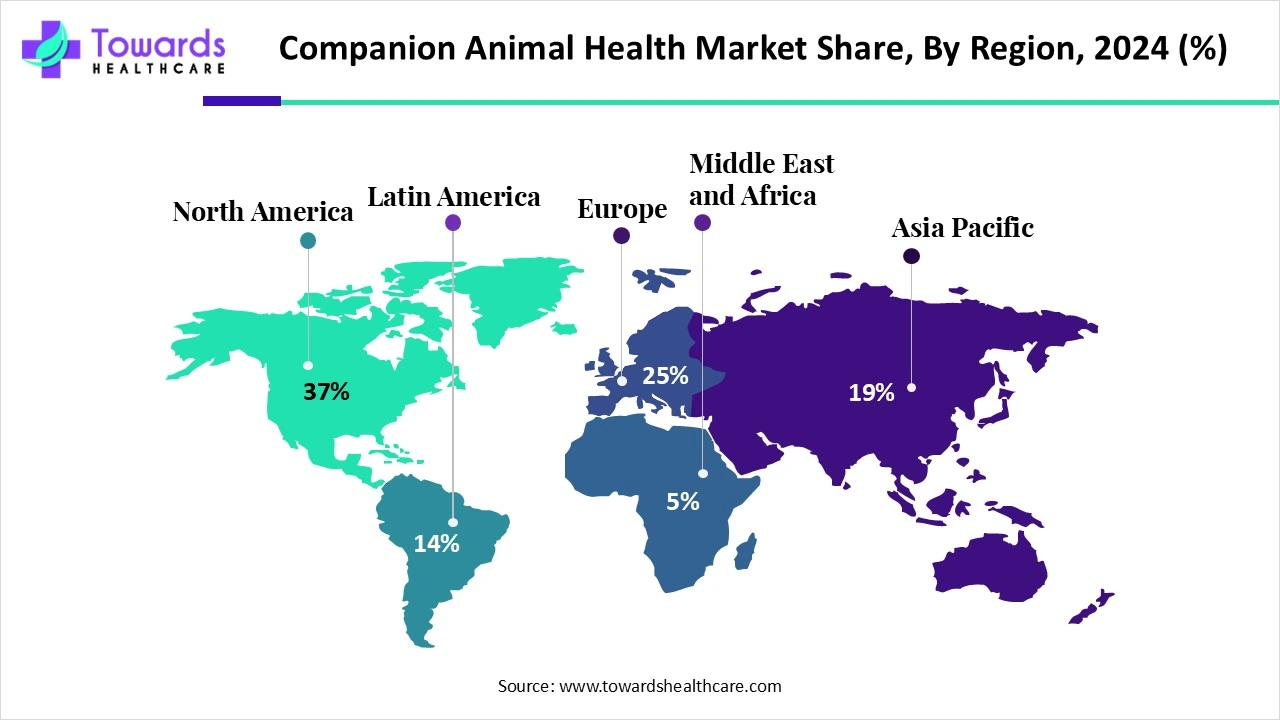

- North America led the companion animal health market share by 37% in 2024.

- Asia Pacific is estimated to grow at the fastest rate in the market during the forecast period.

- By animal, the dogs segment held the major share of the market in 2024.

- By animal, the cats segment is expected to grow at the fastest rate in the coming years.

- By product, the pharmaceuticals segment was dominant in the market in 2024.

- By product, the diagnostic segment is estimated to grow at a significant CAGR during the predicted timeframe.

- By distribution, the hospital pharmacies segment registered its dominance over the global market in 2024.

- By distribution, the e-commerce segment is expected to grow at a lucrative rate between 2025 and 2034.

- By end-user, the hospitals & clinics segment held the largest share of the market in 2024.

- By end-user point-of-care/ in-house testing segment is projected to grow at a significant CAGR during the forecast period.

Market Overview:

The worldwide companion animal health market is enjoying unprecedented growth that begins. This growth demonstrates pet-owners increasing acknowledgment of the status of dogs and cats as family members, and the accompanying willingness to spend for approved pharmaceuticals, diagnostics, and preventative care. The continued advancement of veterinary technology, the prevalence of pet insurance, and a shift in focus from treatment to wellness, are all expanding the market.

In terms of revenue, North America is currently the leading geographical market while Asia-Pacific will be an emerging region of growth. The types of products marketed, from vaccines, therapeutic drugs, and diagnostics to e-commerce delivery solutions, all indicate an active, multi-layered market that will continue to modify, adapt, and innovate.

Explore exclusive insights into how rising pet humanization is transforming the veterinary landscape - download the free sample report now! @ https://www.towardshealthcare.com/download-sample/5515

Major Growth Drivers:

What are the Major Driving Factors for the Companion Animal Health Market?

- Increasing pet ownership and pet humanisation: A greater share of households are now selecting dogs and cats to provide companionship and now consider their pets part of their family, resulting in increased spending in the areas of healthcare, wellness and diagnostics for companion animals.

- Innovative veterinary technologies: Advances in therapies, diagnostics, and digital technologies are allowing for superior preventative care, earlier diagnosis and better treating of diseases in companion animals, thereby driving acceptance from pet-owners and veterinary providers.

- Growing incidence of chronic and infectious diseases in companion animals: Pet lifespan is lengthening and indoor/outdoor lifestyles are becoming more prevalent, resulting in increased incidences of cardiovascular disease, cancer and zoonotic infections, and causing greater demand for advanced healthcare intervention.

- Expanding channels of distribution for health products, and veterinary insurance models: The increase of online retail pharmacies, advancements in e-commerce, and availability of pet health insurance, among other conveniences, are reducing barriers and incentivising pet owners to pursue premium health rather than basic forms of care.

-

Developing countries and disposable income: In emerging markets such as Asia-Pacific or Latin America, increasing middle class and urbanisation is causing rising rates of adoption of companion animals and more owners willing to allocate discretionary spending to health and wellness.

Key Drifts:

A major trend is the growing investment in diagnostics and point-of-care testing for companion animals, which allows for earlier identification of disease and more tailored treatment protocols. The use of RNA-particle vaccine platforms in companion animals is also on the rise as we've recently seen the launch of new canine influenza and feline leukaemia vaccines which utilize sophisticated technologies. Tele-veterinary care and digital monitoring instruments (such as wearables that monitor a pet's health) are gaining popularity as pet-owners want convenience, remote monitoring, and preventive care.

A third trend is the humanisation of pets, which means pet health care is increasingly aligning with human healthcare norms: customized care, wellness check-ups, advanced therapies. Finally, channels of distribution are changing: the rise of e-commerce is occurring quickly, veterinary hospital pharmacies are expanding their availability of products and services, and traditional retail channels are changing.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

Despite this positive momentum, a significant challenge for the companion animal health market is affordability and access to advanced diagnostics and treatment, particularly in emerging markets. Advanced diagnostics, new biologics, and premium treatment options are too expensive for many cost-conscious pet owners.

In addition, in most rural or under-developed markets, the veterinary infrastructure is limited, with a lower density of specialty practices and the availability of diagnostics and innovative treatments. The uneven distribution and availability of these technologies is likely to hinder market growth in less developed markets and restrict the global penetration and growth of high-value segments.

Regional Analysis: North America to Sustain its Dominance; Asia to Boom Rapidly

The companion animal health market is the largest in North America by 37% and is regarded as the largest market globally, primarily due to high rates of pet ownership, developed veterinary practices, and more comprehensive insurance for pets than in any other global region. Specifically, the U.S. market has long been characterized by pet humanisation, with pets being considered family members and with considerable annual spend on pet health and wellness. Established manufacturers of pharmaceuticals and diagnostics are present in the region and the engagement of these organisations in new product launches and service enhancements sustains growth. Additionally, regulatory and reimbursement environments are established, allowing for faster uptake of novel therapies.

In regard to the health of companion animals, the region of Asia Pacific represents the fastest growing compatible market. Accelerated pet ownership, higher disposable incomes in urban environments, and trends in pet humanisation indicate potential for growth of the market in this region. For example, countries in Asia Pacific such as India and China are experiencing high growth in the ownership of companion animals, along with movement towards a preventive health focus for pets. Many of the international animal health companies have invested in new manufacturing, vaccine and diagnostics strategies to capture potential growth in the region, as well. Regulatory enhancements, increased veterinary capacity, and veterinary clinics being established in specialty areas, will also provide increased momentum in this region.

See how North America leads the market while Asia Pacific emerges as the fastest-growing hub - unlock regional insights tailored to your business focus here! http://www.towardshealthcare.com/checkout/5515

Segmental Insights:

By Animal:

In 2024, the dog’s segment had the largest share. Dogs are still the most commonly owned companion animal in the world and are often considered family and receive valuable expenditure on their health. There are many chronic and acute conditions that dogs can suffer from, creating a demand for pharmaceuticals, diagnostics and wellness solutions. For example, cardiac, orthopaedic, parasitic or infectious diseases are among the most common canine health challenges. In addition, dog owners are even more frequently buying their dogs premium care, advanced diagnostics and long-term wellness and preventative care. The dog segment's dominance aligns with the high number of pet dog ownership and the willingness of dog owners to spend money on their dog's health.

The cat’s segment is forecasted to grow dynamically in the upcoming years. Cat ownership is increasing rapidly in several urban markets around the world, due to lifestyle shifts which favour smaller living spaces and less time-consuming pets. As the profile of the cat owner becomes more health-conscious and more willing to pay premium services, the market for diagnostics, therapeutics and preventive care for cats is expanding. Cats also present a unique set of health-care challenges, such as feline leukaemia virus (FeLV) and chronic kidney disease, which require veterinary specialization.

By Product:

The pharmaceuticals segment led the companion animal health market in 2024. Therapeutics, either prescription or over-the-counter, continue to hold the largest share of market revenues as they are used to treat pets with chronic and acute diseases. The major drivers of this are improvements in veterinary pharmacology (in addition to biologics), coupled with the willingness of pet owners to use more advanced medications to treat their pets. Additionally, pharmaceuticals have greater per-unit value in the market than some diagnostics or preventative products. We also see new drugs coming to market for companion animal indications. Veterinary formulations, biologics and conditional therapies mean the pharmaceuticals segment will continue to lead this market.

The diagnostics segment is projected to experience a high compound annual growth rate (CAGR) during the forecast period. Increased awareness of disease detection in pets, the push for a point-of-care in veterinary clinics, and improvements in molecular diagnostics are all factors that are driving growth in this segment. Veterinary diagnostics represents an opportunity for the veterinarian and pet owner to shift from reactionary treatment focused care models towards preventive care models, both of which are in line with humanisation. As point-of-care diagnostics becomes more affordable and accessible (in some cases via e-commerce models), we expect the diagnostic segment to continue experiencing significant growth potential.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Distribution:

Distribution via hospital pharmacies, the major distribution avenue of the global companion animal health market in 2024, is at the epicenter of all pet-health focused veterinary visits, specifically when pet-owners are seeking time-sensitive and expert care on their animal's serious issues or specific care regimens. Veterinary clinics and hospitals with in-house pharmacies provide more convenience and inherent trust when managing access to pharmaceuticals, vaccines and diagnostics through veterinary hospitals. The distribution channel further benefits from chief advantage of direct veterinarian-pet-owner interaction regarding product recommendations and dispensing products in real-time via visit.

The e-commerce distribution segment has strong growth potential in 2025-2034. Proliferation of online pet-health platforms, subscription model-based products, direct-to-consumer diagnostics kits, and tele-veterinary consult with convenience is all expanding access for pet-owners. In tandem with easier access to research, the broader adoption and trust of ordering pet-health solutions for delivery through shipping (logistics advances that continue to improve globally), e-commerce presents as the channel positioned for growth within the companion animal health market. E-commerce represents an opportunity to provide access to care to pet-owners in more isolated geographical areas while leveraging lower cost pet wellness care and preventive care access.

By End-user:

In 2024, the largest share of the companion animal health market will be held by the hospitals & clinics end-user segment. Veterinarians typically diagnose, treat, recommend, and perform surgery at veterinary hospitals and clinics that specialized in the treatment of animals. Pet owners take their pets to clinics for all the variables that result in the typical demand for companion animal health products for pets. These are also the prescriptive and influencing facilities for veterinarians to recommend and prescribe pharmaceuticals in the clinic especially important for wellness and diagnostics. The large share for the hospitals & clinics end-user segment is reflective of the observation that serious and clinical diagnostics and the treatments, are typically not in the retail or online segments.

The point-of-care / in-house testing segment is expected to grow with significant compound annual growth rate, CAGR, in the forecast period. Veterinary practices will increasingly replace laboratory testing with in-house diagnostic equipment and rapid testing kits to reduce the time to diagnosis and his/her treatment. The trend of pet owners requesting wellness care is encouraging clinical investigators to provide wellness-testing services to monitor biomarkers or chronic disease states. As the technology continues to mature to be miniaturized, reliable, and cost-effective, clinics will offer various point-of-care diagnostic services on behalf of the pet for more timely clinical evaluation and diagnostics.

Browse More Insights of Towards Healthcare:

The global animal biotechnology market size is calculated at US$ 28.17 in 2024, grew to US$ 30.97 billion in 2025, and is projected to reach around US$ 72.6 billion by 2034. The market is expanding at a CAGR of 9.93% between 2025 and 2034.

The global monoclonal antibodies in veterinary health market size is calculated at US$ 1.23 in 2024, grew to US$ 1.45 billion in 2025, and is projected to reach around US$ 6 billion by 2034. The market is expanding at a CAGR of 17.13% between 2025 and 2034.

The global animal genetics market size is calculated at USD 6.51 billion in 2024, grew to USD 6.93 billion in 2025, and is projected to reach around USD 12.11 billion by 2034. The market is expanding at a CAGR of 6.4% between 2025 and 2034.

The global animal model market size is calculated at USD 2.54 billion in 2024, grew to USD 2.76 billion in 2025, and is projected to reach around USD 5.81 billion by 2034. The market is expanding at a CAGR of 8.64% between 2025 and 2034.

The global animal vaccine market size is anticipated to grow from USD 18.98 billion in 2025 to USD 44.77 billion by 2034, with a compound annual growth rate (CAGR) of 10% during the forecast period from 2025 to 2034.

Recent Developments:

In February 2025, Merck Animal Health’s injectable formulation of its product Bravecto Quantum (fluralaner) was awarded “Best New Companion Animal Product” by S&P Global Animal Health, highlighting innovation in pet parasiticide delivery.

Companion Animal Health Market Key Players List:

- Endovac Animal Health

- HIPRA

- Norbrook Holdings Limited

- Zoetis

- Chanelle Pharma

- Virbac SA

- Vetoquinol

- Merck & Co

- Elanco Animal Health

- Dechra Pharmaceuticals

- Ceva Sante

- Boehringer Ingelheim International GmbH

Discover who’s shaping the future of pet health — from Zoetis to Elanco and Merck Animal Health, get a detailed look at market leaders and their innovation strategies. https://www.towardshealthcare.com/checkout/5515

Segments Covered in the Report

By Animal

- Dogs

- Equine

- Cats

- Others

By Product

- Vaccines

- Pharmaceuticals

- OTC

- Prescription

- Feed Additives

- Diagnostics

- Others

By Distribution

- Retail

- E-commerce

- Hospital pharmacies

By End-Use

- Point-of-care/In-house testing

- Hospitals & Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Stay ahead in the booming USD 61.74 billion companion animal health market — access the complete report today and lead with data-driven confidence! https://www.towardshealthcare.com/checkout/5515

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.